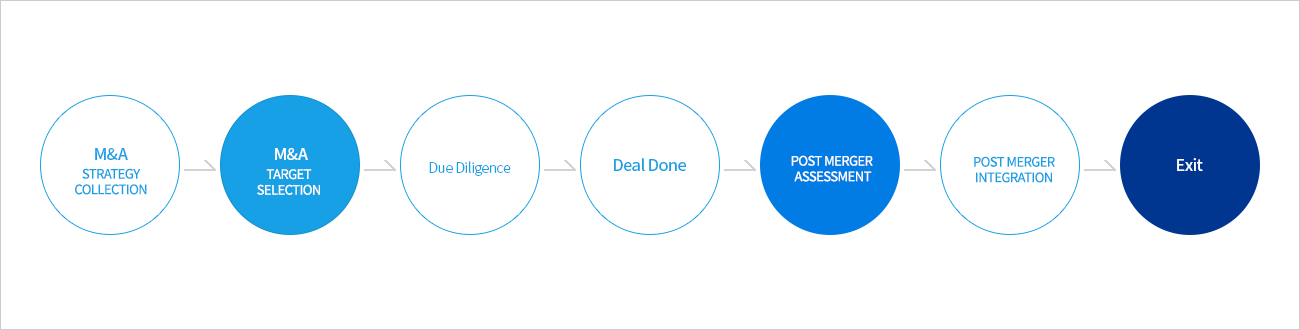

Before proceeding with PMI, we look deeply into the acquiring company and see if there were any distortions in the due diligence data, unreasonable and inefficient customs or indictment within the organization, whether there were any unethical acts by employees, whether important business secrets or intellectual property of the company are well protected. This is called PMA(Post Merger Assessment).

The "Due Diligence" (which is a general takeover process for a company) is only available to the data provided by the companies subject to the acquisition, and the purpose is also to measure the financial value of the enterprise. Therefore, it is difficult to grasp the structural problems inside the actual acquiring company, the unreasonable and inefficient customs or indictment, any unethical acts, or the absurdities that are not exposed to the surface.

After the acqusition is completed through PMA, you can identify unknown problems within the acquiring company and reflect them in the PMI plan.

This prevents long-term risks after integration by presenting the right direction for the integration work to be completed efficiently and effectively.